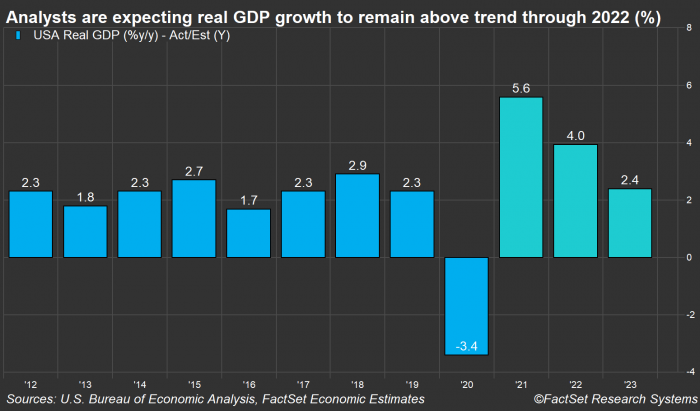

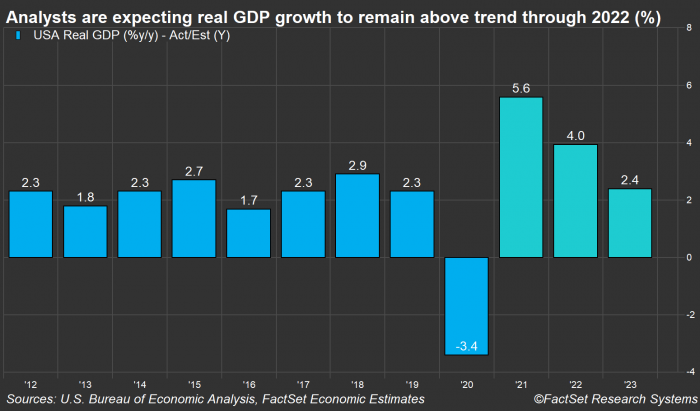

Economic slowdown predicted for the beginning of 2023

Katherine Patterson

December 5, 2022

Nolan Lantin is almost completely financially independent while being a full-time student at Indiana University. His time is stretched across three extra-curricular activities and two part-time jobs.

“It’s heavy stress all the time,” said Lantin, “especially with how much money you’re putting out and how much you have to put on the table just so you can have your next meal.”

The inflation rate this year rose to just under nine percent. With healthy inflation sitting at four times less, it makes balancing finances and education that much harder.

“Because of how much I’m doing, especially with money-making, there have been plenty of days where I just skip class and just work,” said Lantin.

Full interview with Professor at Kelley School of Business Philip Powell

Economists at the Kelley School of Business are seeing a lowering of inflation rates across the country. However, these rapid drops in prices could mean a recession is in the near future.

“We think the economy is going to slow down next year, which is going to negatively impact the job market.” Said economist Kyle Anderson, “so, for folks coming onto the job market within the next year, you just need to be aware that it’s probably not going to be as strong by next June as it is right now or has been for the last few years since the pandemic.”

With employment and finances being the top priority in Nolan’s mind, it’s easy to be worried.

“It’s kind of taken an emotional toll on me because I know I should be focused on my studies and doing well so that I can make it through college and eventually have a job…but it’s not all that bad knowing, I’m not alone in the struggle that I’m in.”

Data Courtesy of "FactSet"