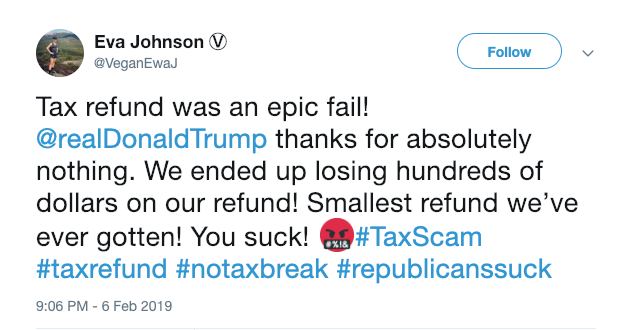

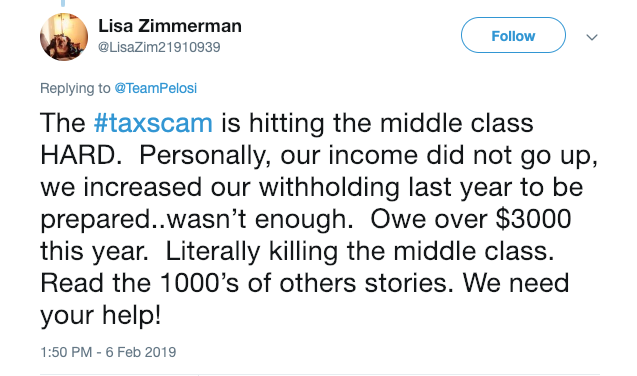

Millions of Americans around the country are in a panic this week after learning that there has been a change to their taxes.

The shock comes two weeks into the 2019 tax season with over 30 million Americans filling and receiving less money in tax returns than they anticipated. In fact, many are finding that they owe the Internal Revenue Service money because of the change in tax policy under the Tax Cuts and Jobs Act of 2017 (TCJA).

According to CNBC, refunds are down 8.7 percent on average from $2,135 to $1,949 compared to this same period last year.

The TCJA was the most comprehensive change to the tax legislation since the Tax Reform Act of 1986. The legislation reduced the tax rates for most individual taxpayers and corporations as well. However, the reduction for individuals is only temporary, lasting through 2025, whereas they are permanent for corporations.

Bradley Heim is an IU professor who studies the impact of taxes on society and he used to work at the Treasury Department. Heim said experts and insiders like him were aware of these changes but not many average Americans.

“It was hard for people to figure out how much they are going to owe under the new system,” Heim said. “It’s hard to compare that to how much is being taken out and so at the end of the day the refund ends up being very hard to predict. I am not surprised people are surprised at all.”

Under the new law, Americans were allowed to keep more money from their paychecks, with the understanding that they would receive less money in their tax refund or even owe the IRS.

Not all Americans were blindsided by this tax season. Megan Mahaffey is a Bloomington mother of three who said her job as a tax preparer meant she knew what to expect this tax season. She said she has even been able to take advantage of the policy change.

“For a lot of parents we were put into a position of advantage because the child tax credit which previously been up to a thousand dollars per qualifying child was expanded to a two thousand dollar tax credit,” Mahaffey said.

So as a mother of three she benefited from one of the changes.

Heim said the average American was not paying close enough attention but that people shouldn’t worry about these initial numbers. The reason is that smaller tax refunds not mean you were cheated.

A refund is merely the amount you overpaid to the IRS being returned to you, Heim said.

If you want, you can ask your employer for a W-4 with which you can specify how much you want the government to take; that way you can go back to having the returns you are accustomed to.

“A bigger refund is not necessarily better,” Heim said. “If you’re getting a $10,000 refund at the end of the year on the one hand that is fantastic you got $10,000 dollars to spend now, on the other hand, you could have $800 extra every month over that year rather than getting one check.”

He said only time will tell how effective the tax legislation is because judging legislation this soon would be premature.

“The advice going forward is that the way things are this year are the way it’s going to be for the next few years,” Heim said.